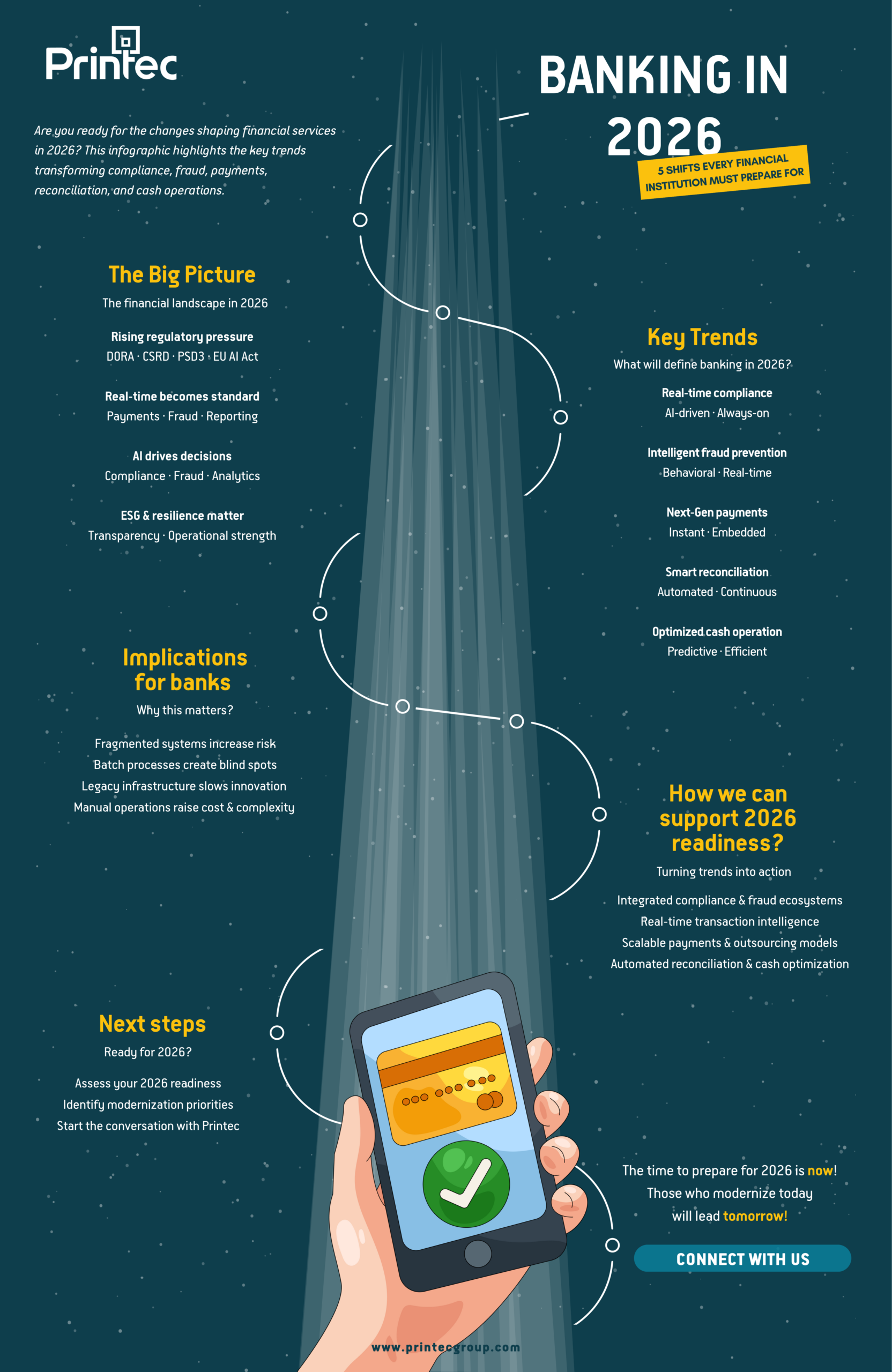

Top 5 trends shaping banking in 2026

- Real-Time Compliance: AI-driven, always-on compliance and reporting.

- Intelligent Fraud Prevention: Behavioral analytics and real-time monitoring.

- Next-Gen Payments: Instant, ISO 20022-ready, and embedded finance.

- Smart Reconciliation: Automated, integrated, and continuous control processes.

- Optimized Cash Operations: AI forecasting, fewer CIT trips, higher efficiency.

These trends directly impact operational efficiency, regulatory readiness, and customer trust.

Implications for banks

Institutions that fail to modernize risk:

- Fragmented systems increase operational risk.

- Batch processes create blind spots and slow decision-making.

- Legacy infrastructure hinders innovation and agility.

- Manual operations raise cost and complexity.

Adopting unified, intelligent, and automated solutions across compliance, fraud, payments, and reconciliation is essential to stay competitive.

How we support financial institutions

With over three decades of experience and operations in 17 countries, we partner with world-class providers like IMTF, INETCO, Worldline, NCR Atleos, and Sesami to deliver:

- Compliance Automation: Real-time monitoring, ESG reporting, and AI-driven risk controls.

- Fraud Prevention: AI and behavioral analytics for seamless, auditable detection.

- Payments Modernization: ISO 20022-ready systems, instant payments, and Payment-as-a-Service solutions.

- Reconciliation & Cash Optimization: Automated matching, exception management, and AI-driven cash cycle efficiency.

Our solutions help banks turn complexity into competitive advantage, ensure regulatory alignment, and improve customer trust.

The time to prepare is now. Institutions that modernize today will lead tomorrow.

Let Printec help you assess readiness, define a digital roadmap, and implement future-ready solutions that ensure compliance, resilience, and operational excellence in 2026 and beyond.